Originally published by Space Intel Report on August 25, 2025. Read the original article here.

(Source: Hogan Lovells)

(Source: Hogan Lovells)

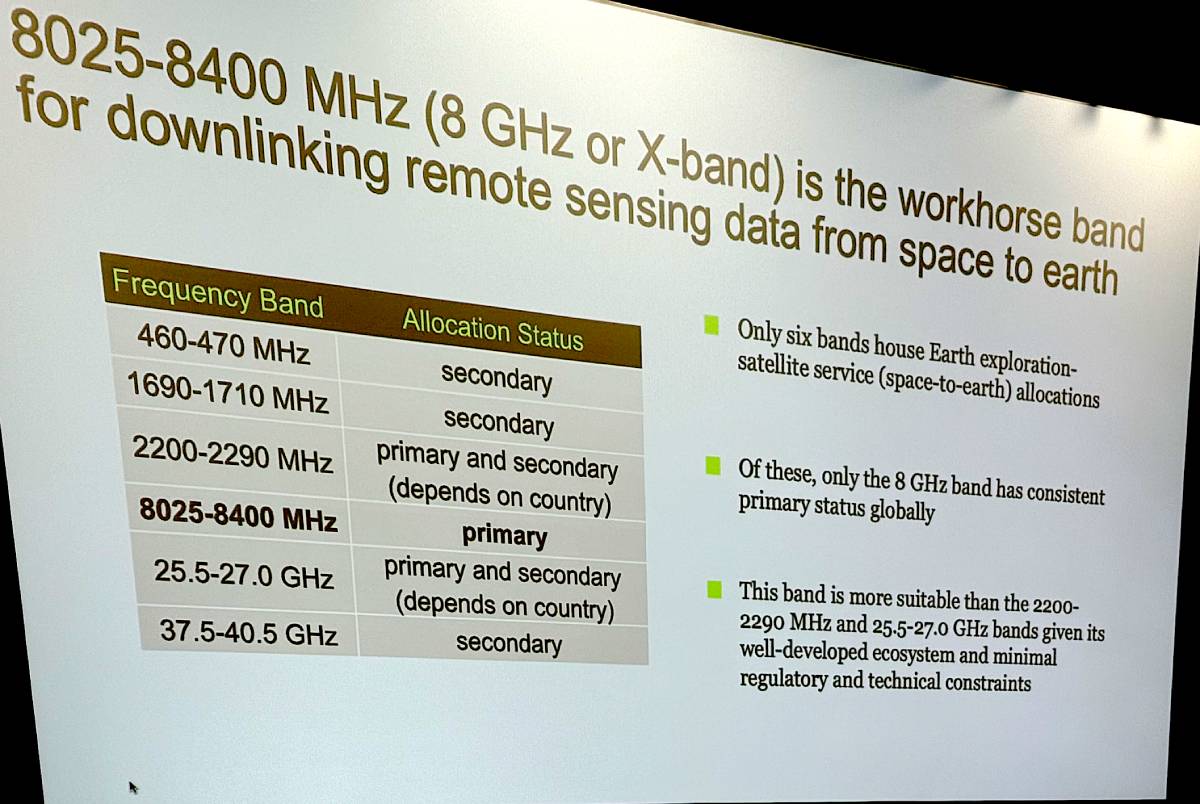

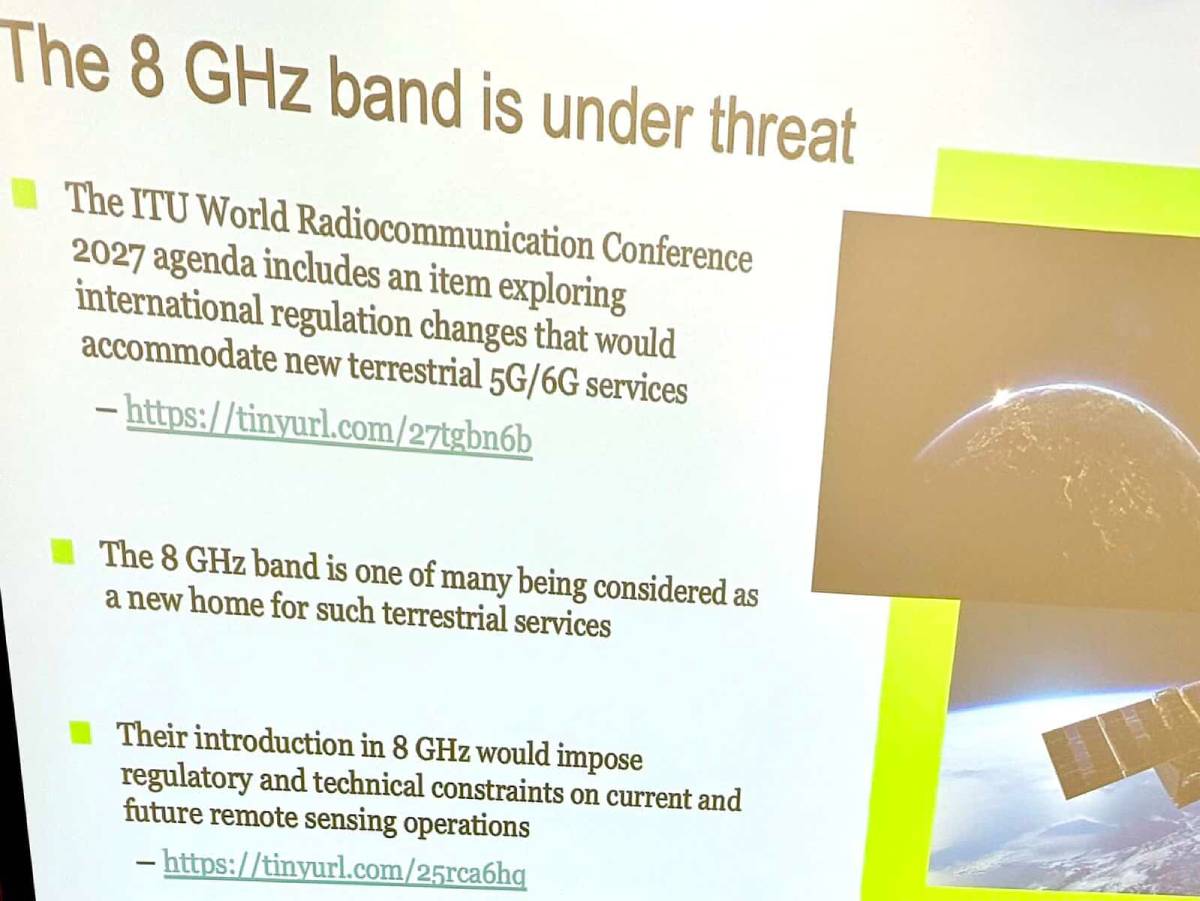

SALT LAKE CITY, UT — Half-way between the last and the next World Radiocommunication Conference (WRC), it remains unclear how global radio frequency regulators will vote when asked whether the 8-GHz X-band spectrum, where satellites have primary status, should be thrown open for use by terrestrial mobile broadband services.

The 194 national members of the International Telecommunication Union (ITU) are well-known for waiting until the last minute for disclosing their positions, and the same looks to be true for WRC-27, scheduled for Oct. 18-Nov. 12 in Shanghai.

At first glance, the correlation of forces would appear favorable to retaining the 8.025-8.4 GHz, or X-band, spectrum reserved for satellite Earth observation systems and rejecting co-existence with terrestrial broadband base stations.

An increasing number of military agencies are using X-band in North America, Europe and the Middle East, and one of the six regional groupings, the Russia-dominated RCC, also has vested interest in retaining spectrum for X-band geospatial imaging.

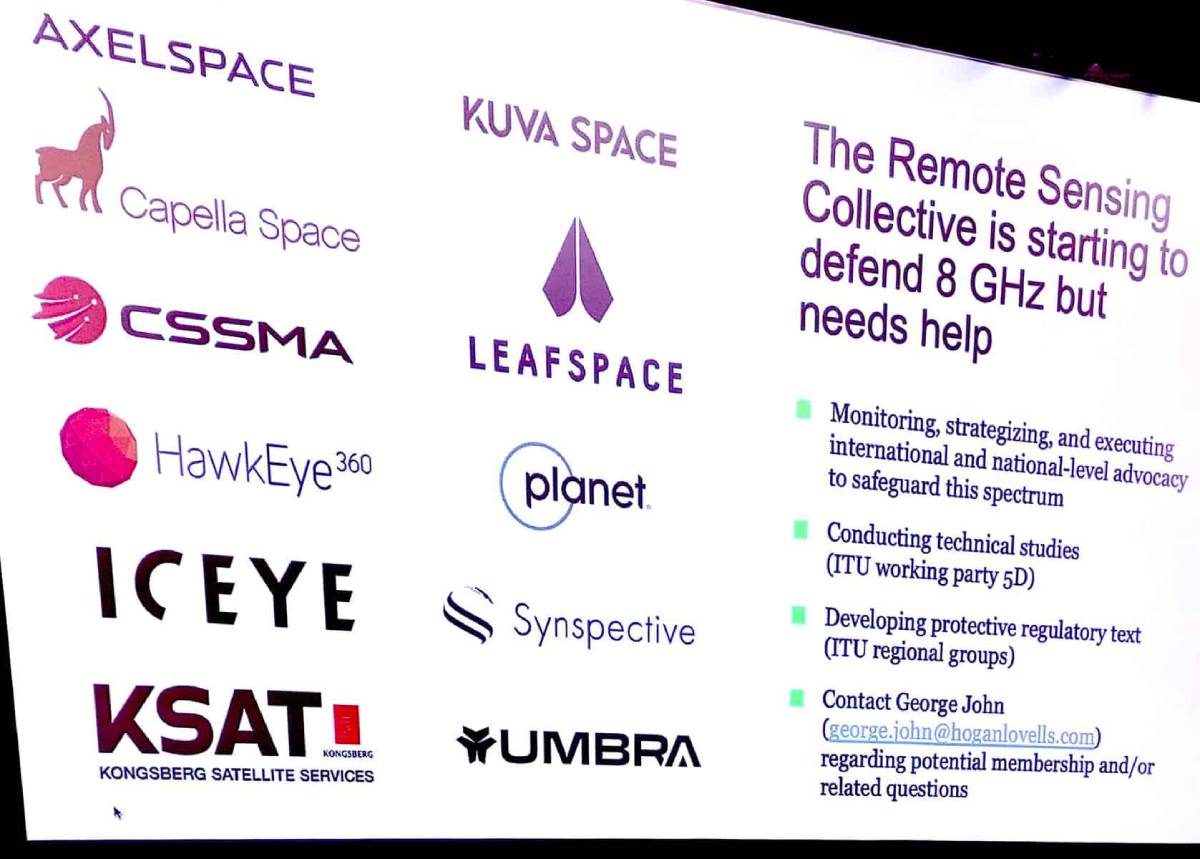

The Remote Sensing Collective members. (Source: Hogan Lovells)

The Remote Sensing Collective members. (Source: Hogan Lovells)

But 11 companies with an established interest in X-band have created the Remote Sensing Collective to begin a lobbying effort to head off the usual wealth and influence advantages of the 5G players coordinated by the GSMA.

The Collective is missing some names that have a direct interest in retaining satellite spectrum priority for X-band, including MDA Space of Canada, whose next-generation Radarsat program, Chorus, includes an X-band satellite built by Iceye of Finland to follow the Radarsat C-band spacecraft in a tip-and-cue mission; and Space42 of the United Arab Emirates, which has purchased seven Iceye X-band radar satellites and is building its own domestic factory for the purpose.

The law firm Hogan Lovells is coordinating the Remote Sensing Collective effort and keeping tabs on where the six ITU regional groupings stand on the issue.

At an Aug. 13 presentation here at the Small Satellite Conference, George V. John, of counsel at Hogan Lovells, said reports coming in give reason for cautious optimism that the WRC-27 proposal will be rejected, but it cannot be considered a sure thing.

(Source: Hogan Lovells)

(Source: Hogan Lovells)

“The band 8025-8400 MHz is the bloodline for Earth observation remote sensing satellites, John said. “If anything were to happen to it, we’re out of luck. We’re going to have to go through the ITU process to try to get additional spectrum for us.” That could take years.

“The 5G-6G people — the Verizons, AT&Ts, T-Mobiles — have run out of spectrum that was greenfield, so they try to take from others, like the smallsat folks, and say: ‘You all are not using it as much a we will be using it, and by the way we will pay the US government a lot of money, billions of dollars, to help pay off the debt, and we’ll provide you great terrestrial 5G-6G service,” John said.

An early focus of the Collective is to commission technical studies showing the impact of an X-band 5G-6G tower on nearby X-band Earth stations. John said the results so far show that a large perimeter would need to be formed around the satellite facility to prevent its being overwhelmed by the terrestrial broadband tower.

“We are coming to the conclusion that, no, there isn’t any world where we are going to be able to do that because we are going to want to deploy additional Earth stations in the future. Just grandfathering the current Earth stations is not going to be sufficient.”

Mobile X-band satellite Earth stations designed to move in and out of disaster areas to image stricken areas would be compromised if terrestrial broadband networks were already there.

There’s time to prepare for WRC-27, but by early 2026 the geospatial side would need to be prepared to propose regulatory text to the different pre-WRC-27 meetings that’s backed up by credible technical studies.

“It is not going to be possible for just these 11 companies to do it on their own,” John said of the current Collective membership. We need to have more of a global presence, because this is a global issue.”

(Source: ITU)

(Source: ITU)

John said that as of now, the state of play in the six regional areas, which may change, is as follows:

— CITEL, representing the Americas: Brazil and Mexico appear to be in favor of opening X-band to terrestrial 5G, while the United States’ recent budget bill succeeded in preserving the spectrum for satellite.

“CSSMA [the Commercial Smallsat Spectrum Association] was on Capitol Hill to make everyone aware that this 8-GHz spectrum is important for DoD,but also for commercial remote sensing assets,” John said. “We were able to get it excluded from that bill. It cannot be auctioned or used by [5G telcos] inside the United States for the next 10 years. I expect the US and others will stay quiet or actually oppose it when it comes to CITEL.”

— CEPT of Europe appears firmly in opposition to opening X-band to 5G.

— ATU of Africa appears to be withholding a firm position until much closer to WRC-27.

— ASMG, the Arab grouping, similarly looks to be waiting until the eve of WRC-27 despite the interest of UAE’s Space42 and Neo Space Group (NSG) of Saudi Arabia in creating a domestic geospatial imaging industrial base.

— RCC, the former Soviet Union, looks ready to reject the proposal given the military interest in keeping X-band open for satellite imaging.

— APT, the Asia-Pacific, for now looks like a wild card. John said Japan and South Korea, both with large terrestrial-mobile industries, may be ready to push for opening the spectrum for wider 5G use.

“Overall it’s trending in a better direction in the past two months, but anything can change at the last moment,” John said.

Originally published by Space Intel Report on August 25, 2025. Read the original article here.