Originally published by Space Intel Report on September 16, 2025. Read the original article here.

Charlie Ergen. (Source: CNET via Youtube)

Charlie Ergen. (Source: CNET via Youtube)

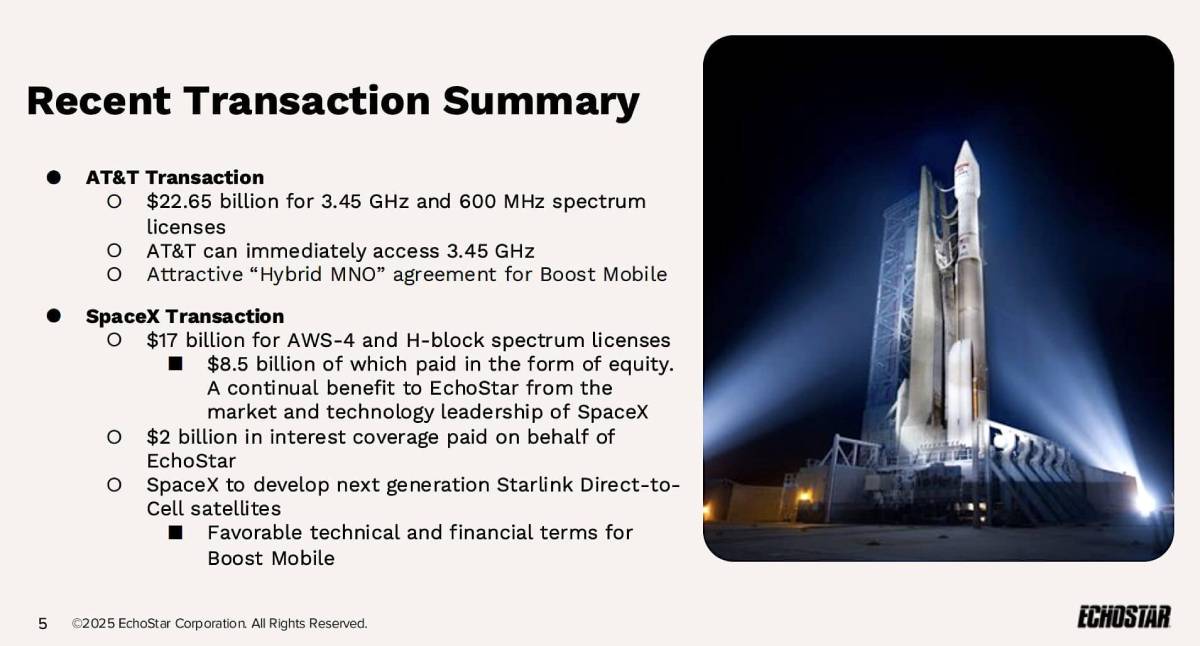

PARIS — Did EchoStar sign its $1.3-billion contract with MDA Space to build an S-band direct-to-device (D2D) constellation at least partly to lure SpaceX into what became SpaceX’s $17-billion purchase of the spectrum?

Industry officials said EchoStar began negotiations with SpaceX over the spectrum in just weeks after the US Federal Communications Commission (FCC) warned the company, in a May 9 letter, that it had sat on its spectrum holdings too long and was at risk of having it confiscated.

Three months later, in August, EchoStar reached its $23-billion deal with AT&T for a large tranche of EchoStar’s spectrum assets. There was no deal yet with SpaceX.

On Aug. 1, SpaceX and MDA Space of Canada announced a $1.3 billion contract to start work on a D2D constellation using MDA’s new Aurora software-defined satellite product. Globalstar has contracted to use the same Aurora design for its D2D service with its principal customer, Apple.

(Source: EchoStar Sept. 15, 2025, presentation)

(Source: EchoStar Sept. 15, 2025, presentation)

On Sept. 8, EchoStar announced it had concluded an agreement with SpaceX for $17 billion, half in cash and half in SpaceX common stock valued at $212 per share. On the same day, it announced the cancellation of the MDA contract.

EchoStar will have to pay MDA terminal liabilities to cover the work MDA performed during the five-week interval between announcement and cancellation.

In a Sept. 15 briefing here during World Satellite Business Week (WSBW), organized by Novaspace, EchoStar Chairman Charlie Ergen and Chief Executive Hamid Akhavan agreed that the FCC May threat was not the principal motivation for the SpaceX transaction. The agency’s warning would have been largely satisfied with the AT&T deal.

Ergen told investors in 2022 that the last thing he wanted to do was enter into a direct competition with SpaceX, which has an apparently unlimited supply of cash. Even with a superior technology, Ergen said, it’s a losing game to play.

There’s no reason to think he has changed his mind about these, even if his company appeared ready to embark on what ultimately would have been a $5-billion commitment to build its own D2D constellation using its global S-band regulatory rights.

(Source: EchoStar Sept. 15, 2025, presentation)

(Source: EchoStar Sept. 15, 2025, presentation)

Here’s how Ergen addressed the question at the Sept. 15 briefing:

“We actually went to SpaceX, I think about eight years ago, to get them to build this for us,” Ergen said of the company’s S-band assets. “They declined to do that. They were not interested in buying spectrum. That changed a bit once we got a fair price.

“We were excited about going on our own because we designed a really good system, but certainly not at the scale that SpaceX could do,” Ergen said. “They have been a vendor for us a long time, they have been one of the best vendors I have experienced within 45 years. They have done incredible engineering stuff for us in terms of launches and changing things at the last minute.”

(Source: EchoStar Sept. 15, 2025, presentation)

(Source: EchoStar Sept. 15, 2025, presentation)

It might the logical for someone who has just purchased $8.5 billion in SpaceX stock to laud the company’s value. But Ergen went beyond that.

“Now that we are going to be cash-rich and asset-light, we are going to be investors in SpaceX. Of all the things I see in the world today, if I could make one investment other than in ourselves it would be SpaceX. They’ve got 90% of the launch capacity in the world today and I think that will even grow with Starship and they have a manufacturing capability that is highly automated. They have a different way of thinking.

“Because they are in the broadband business already with high frequency, and inter-satellite links, people will see them go in places people haven’t been thinking about, so we were going to try to interface with them anyway. That just became a natural once they were willing to pay the price for the spectrum.

“We certainly would invest more in SpaceX today at the price we bought in to SpaceX. They have a huge moat around what they do. They are very diverse between consumer and government in terms of customers. They are in a unique position.

“They paid us $17 billion but they are going to make way much more money. Look at our spectrum position, built over 15 years. We have the highest-value ITU rights. That means nobody can interfere with SpaceX in this frequency. So this is 40 MHz around the globe that nobody can interfere with SpaceX.

“They have the ability to combine broadband and handsets so, they will be able to go to your home and they are able to go to the phone in your pocket. So they will be able to marry those together. And if you really think about what that means, its a big moat.”

Hamid Akhavan. (Source: Connecting the World video)

Hamid Akhavan. (Source: Connecting the World video)

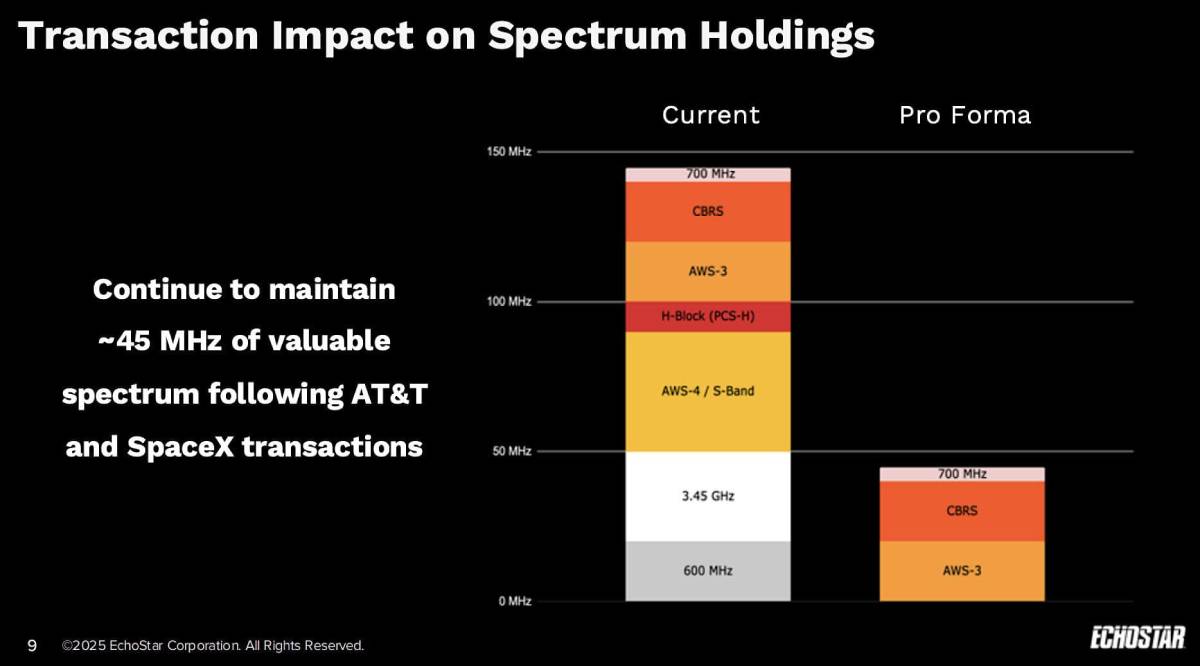

Akhavan had a slightly different take on the decision to sell to SpaceX. He said that because the AT&T transaction included EchoStar’s 600-MHz spectrum, the company’s plans for developing its Boost Mobile network was made less attractive. It needs both the 600-MHz and the S-band spectrum for maximum effectiveness.

“Both those pieces of spectrum were actually used in our network,” Akhavan said. “If you did a transaction in either one of these you were forced into the second transaction. In the mobile business, once you start losing a critical mass of spectrum, you will become sub-critical. We have talked about how important spectrum is, but if your ownership drops to a certain point you no longer are competitive.”

Akhavan said this “snowball effect” following the AT&T sale meant EchoStar “could no longer maintain a critical mass to remain a viable player. We did the best we could do.”

(Source: EchoStar Sept. 15, 2025, presentation)

(Source: EchoStar Sept. 15, 2025, presentation)

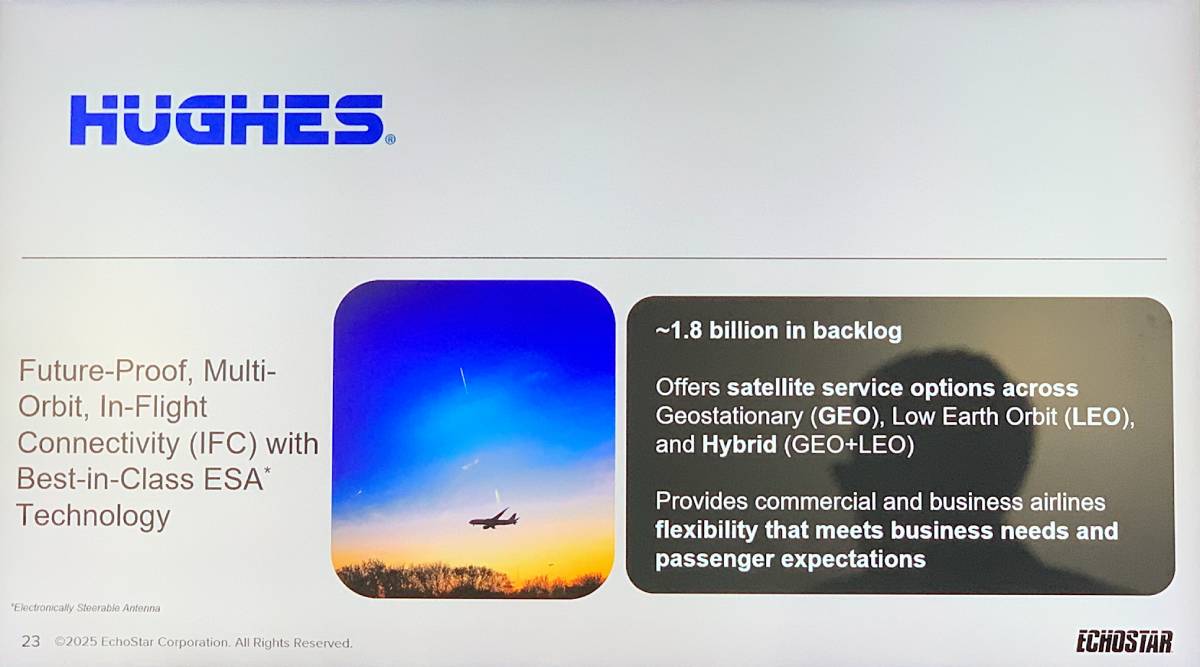

Akhavan said EchoStar’s Hughes division, which provides satellite broadband services in North America from its own Ka-band spacecraft in geostationary orbit, is gradually migrating away from consumer broadband under pressure from SpaceX Starlink and others. The new Hughes will become a provider of enterprise broadband.

He said Hughes has a backlog of $1.8 billion in business from commercial airlines for in-flight connectivity, using its own satellites and capacity purchased under a long-term lease from Eutelsat OneWeb’s LEO constellation.

What was not clear is how Hughes expects to grow the in-flight-connectivity business given SpaceX’s focus on that market, with Telesat coming soon with its Lightspeed constellation and Amazon preparing Project Kuiper for an in-flight-connectivity play.

Originally published by Space Intel Report on September 16, 2025. Read the original article here.