Space has become integral to national security, economic resilience and technological sovereignty. As global reliance on orbital infrastructure deepens, maintaining freedom of action and shaping the strategic environment requires robust Space Situational Awareness (SSA) and Space Domain Awareness (SDA). Historically focused on civil safety, these awareness systems must now evolve to address both civil and military needs. As the boundary between peacetime safety and strategic advantage blurs, awareness capabilities must support both operational safety and national security objectives.

SSA: The Operational Backbone of Space Safety

Space Situational Awareness and its key technical components (primarily satellite surveillance and tracking, together with space weather and near-earth object analysis) has been a core part of space operations for decades, forming the foundational layer that enables safe and effective use of orbit. SSA systems track objects, predict conjunctions, and catalogue orbital debris to maintain a clear picture of the operational environment.

This long-standing capability underpins launch safety, satellite manoeuvring and collision avoidance—essential requirements for independent access to and use of space. Furthermore, the capability to ensure the continued safety of space objects also serves to support the sustainability and overall protection of the space environment, thus instituting a virtuous cycle wherein by avoiding the loss of space objects in orbit, the creation of more dangerous clouds of debris is also avoided.

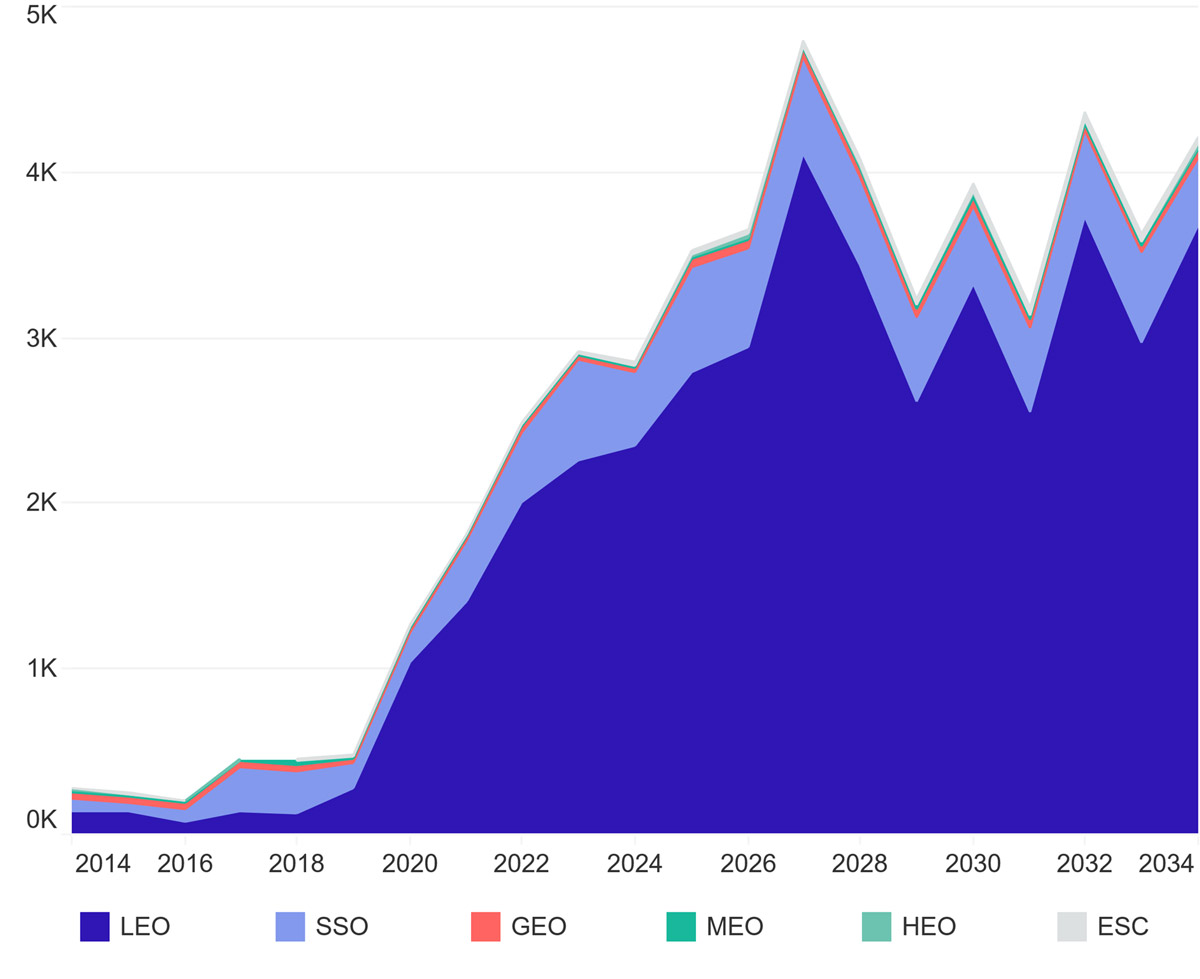

Nevertheless, as deployment of satellites in Low Earth Orbit (LEO) has accelerated and debris clouds proliferate, the need for continuous, near-real-time SSA has intensified. Novaspace estimates that an average of 3,700 satellites will be launched annually between 2024 and 2033, adding to orbital congestion and elevating collision risks. Civil and military operators alike rely on SSA as a baseline capability to maintain operational safety.

Number of Satellites to be Launched by Orbits [1], as of February 2025

Number of Satellites to be Launched by Orbits [1], as of February 2025

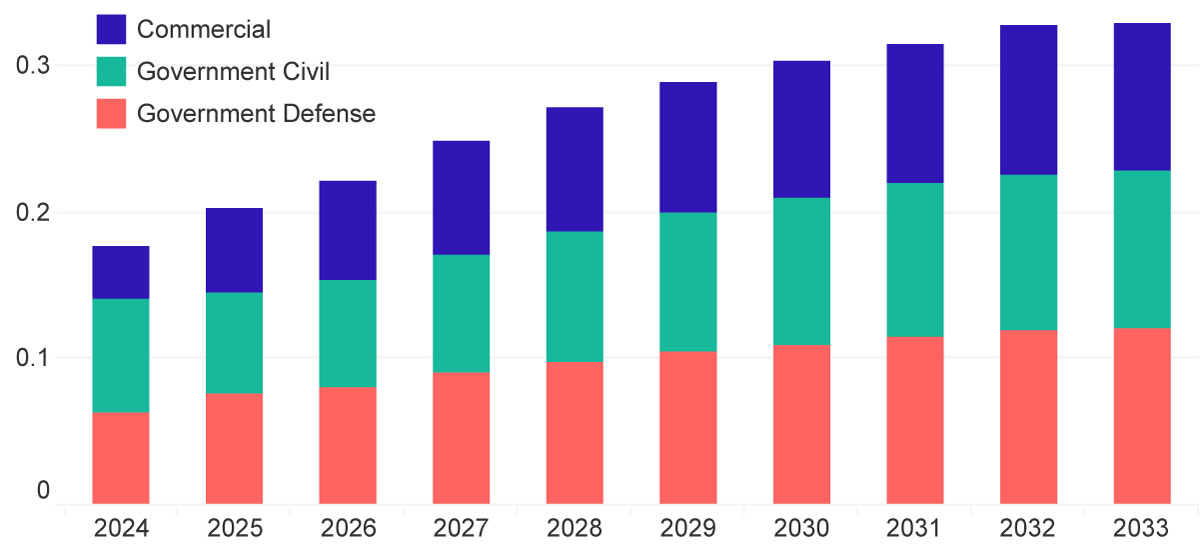

This is also reflected in current market dynamics. As highlighted in the Novaspace SSDA Report, more than $2.7 billion in commercial revenues from the sale of SSA data and services is expected from more than 40 providers over the next decade (2024–2033). Of this total demand, approximately 70% will come from institutional programs, both civil and military, as governments increasingly promote civil acquisition frameworks (such as TraCSS and EU SST) while purchasing commercial datasets to complement defense capabilities. The remaining 30% will be driven by commercial customers, particularly satellite constellations operating in the increasingly congested lower orbital environment.

Global Spending to Acquire SSA & SDA Data and Services Over the Next Decade, in $US Billion

Global Spending to Acquire SSA & SDA Data and Services Over the Next Decade, in $US Billion

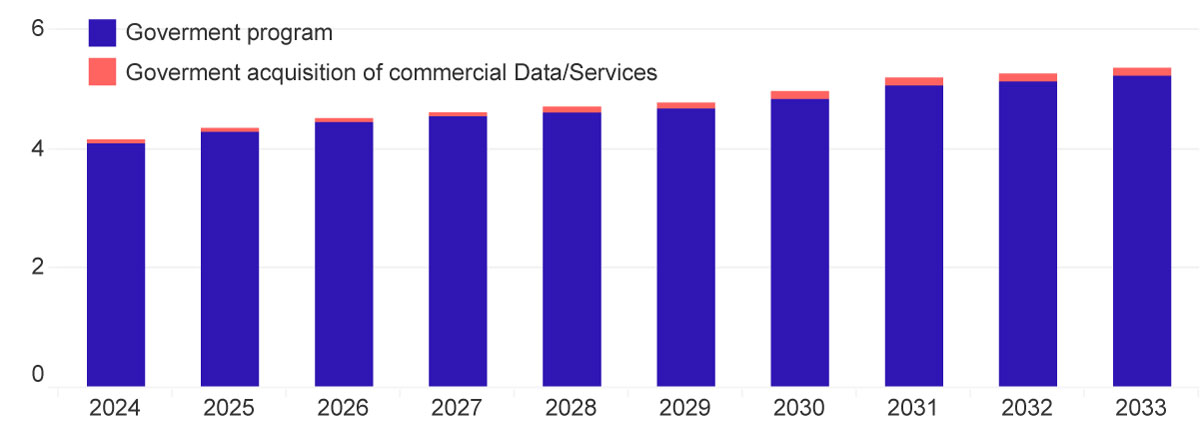

It is important to note that while the commercial market is growing, it still represents a small fraction of total investments in SSA data and services. Indeed, Novaspace estimates worldwide spending on SSA data and services will total $56 billion over the next decade (2024–2033), increasing from $4.8 billion in 2024 to over $6.2 billion in 2033.

Approximately 95% of this spending will come from the procurement and operation of proprietary government assets, primarily led by the US and the EU, along with significant investments from China, India and other countries.

Limits of SSA in a Contested Environment

While SSA is optimised for traffic management and safety, its foundational capabilities are not designed to detect intent or characterise threats. Technical specifications of traditional SSA systems focus on ensuring minimum safety standards for orbital operations, not on identifying adversary behaviour. Grey zone activities such as uncoordinated rendezvous & proximity operations (RPOs) or covert manoeuvring often fall outside the traditional SSA scope.

This limitation underscores the need for enhanced tracking, characterisation and behavioural analysis of both cooperative and non-cooperative assets—an imperative as space has become an established operational domain for deterrence and defence. Addressing these challenges requires moving beyond traditional SSA towards advanced SDA capabilities.

SDA: Evolving Toward Strategic Awareness

Space Domain Awareness has now emerged as a strategic priority for global spacefaring actors. SDA integrates SSA data with behavioural, geopolitical and intent analysis to support threat detection, attribution and strategic decision-making. Systems are designed to detect, warn, characterise, attribute and predict threats in orbit, aligning with the highest-echelon requirements of defence and security users.

According to the Novaspace SSDA Report 2024, governments allocated over $4 billion in 2024 to military programs operating ground- and space-based sensor networks to enhance awareness of the orbital environment, further complimented by $55 million spent on procuring commercial off-the-shelf defence-focused data and services.

Institutional Global Spending to Acquire SDA Defense Data and Services, in $US Billion

Institutional Global Spending to Acquire SDA Defense Data and Services, in $US Billion

SDA focuses on intelligence gathering and monitoring both cooperative and potentially hostile space activities, including satellite manoeuvres, uncoordinated RPOs and counterspace threats. Most SDA data today is generated through military-operated ground-based radar networks, such as the U.S. Space Surveillance Network and Space Fence, as well as China’s SSA radars, including Yuan Wang ship-based systems, and Russia’s repurposed early-warning radars.

Increasingly, dual-use architectures are contributing to SDA efforts, such as the EU SST Partnership network, which integrates civil and military assets, and India’s ongoing NETRA project, which combines space agency and defence capabilities. Looking ahead, dozens of military space-based assets are planned for launch this decade, enabling more precise intelligence gathering and proximity inspection of adversary satellites and operations.

Commercial actors play an important role in SDA development. In the upstream segment, legacy defence companies such as Lockheed Martin, L3Harris and Kratos provide essential sensor infrastructure and services for state-run programs. Meanwhile, firms like LeoLabs have built proprietary global networks, offering off-the-shelf data and services and becoming trusted defence partners. Startups such as NorthStar (Canada) and Digantara (India) are deploying space-based sensors to deliver high-quality SDA data.

Policy, Preparedness and Alliance Dynamics

SDA development raises complex policy questions and alliance implications: transparency versus secrecy, norms versus ambiguity and cooperation versus competition. Operational preparedness is expanding beyond technical tracking, with militaries conducting wargaming simulations to test denial and disruption scenarios and inform the design of SDA systems.

On the one hand, international coordination has gradually increased. Exercises like Global Sentinel and the expansion of Combined Space Operations Centers (CSpOC) enable greater information-sharing among allies. Further, adoption of open data protocols, joint operational standards, data sharing agreements and multinational staff rotations are further signs of a maturing SDA ecosystem.

On the other hand, multinational cooperation remains constrained by trust, legal frameworks, technical obstacles (e.g., system compatibility) and geopolitical considerations. The lack of a clear international rulebook governing grey zone behaviour amplifies strategic uncertainty, driving states to invest in sovereign SDA capabilities to protect national interests.

Looking Ahead: Aligning Capability with Strategy

While SSA remains the operational enabler, SDA is emerging as the strategic differentiator. To ensure effective deterrence and operational readiness, governments must invest in sensor infrastructure, data governance and cross-domain interpretation capabilities. Further still, states are expected to develop intricate security ecosystems through development of forward-looking technologies including quantum key distribution and post-quantum cryptography.

The historical reliance on international collaboration for SSA continues to underpin orbital safety. However, strategic imperatives are driving the development of autonomous SDA capabilities to reduce dependency, enhance resilience and maintain deterrence. Balancing collaboration with sovereign capability-building will define the next decade of space security strategy.

Join Novaspace and key decision-makers in the heart of Paris at the World Space Business Week – the leading global business space event – bringing together 1500+ key space sector actors under the same roof for a week of deal-making and intense discussions shaping the future of the industry.

In parallel to WSBW, Novaspace organises the Space Defense & Security Summit, uniting leaders and shaping the space security of tomorrow.

About the Authors

Anna Purkhauser is a Manager at Novaspace in Munich, advising institutional and defence stakeholders on space policy, capability planning, and strategic innovation.

Marco Borghi is a Manager at Novaspace in Brussels, specialising in strategy development for national and international space actors, socio-economic impact assessments, and corporate strategy development.

[1] LEO: Low-Earth Orbit. SSO: Sun-Synchronous Orbit. GEO: Geosynchronous Equatorial orbit. MEO: Medium Earth Orbit. HEO: Highly Elliptical Orbit. ESC: Escape Orbit.