Originally published by Space Intel Report on August 8, 2025. Read the original article here.

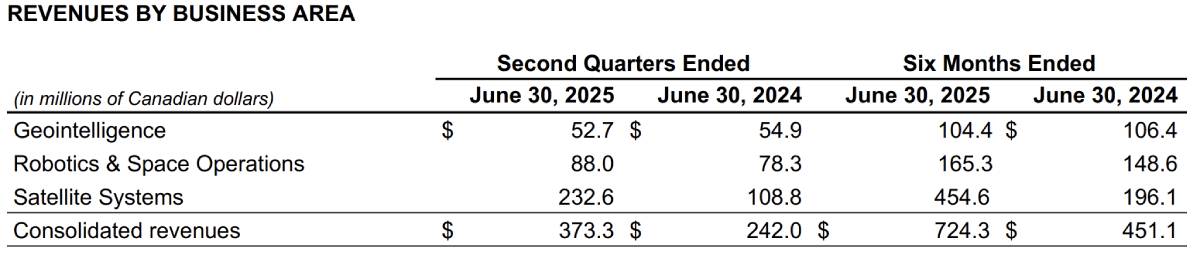

(Source: MDA Aug. 7, 2025, investor presentation)

(Source: MDA Aug. 7, 2025, investor presentation)

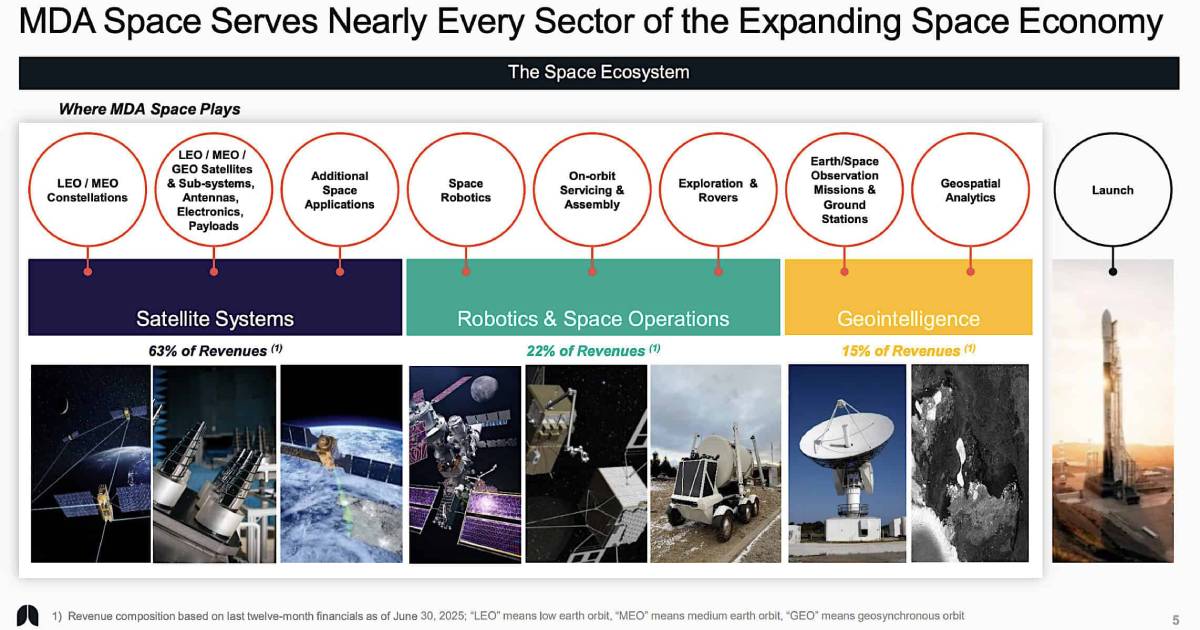

TUPPER LAKE, NY — With four LEO constellations totaling some 350 satellites under contract and a two-satellites-per-day factory opening by December, Canada’s MDA Space is benefitting from a flywheel effect that will make it difficult for any other merchant satellite manufacturer to compete.

Whether any other companies will want to enter the costly LEO broadband space already occupied by Starlink, Amazon’s future Project Kuiper, Eutelsat’s now European Commission-flagged OneWeb and two Chinese constellations is unclear.

It’s even less clear how many will enter the direct-to-device (D2D) competition with LEO constellations of their own, going head to head with Starlink, EchoStar, AST SpaceMobile, Globalstar/Apple, Lynk Global with SES and others.

In an Aug. 7 investor call, MDA Space Chief Executive Officer Mike Greenley said that even after the recently announced EchoStar contract — 1.8 billion Canadian dollars ($1.31 billion) for 100 satellites, and options for another 100 satellites bringing the contract to 3.5 billion Canadian dollars — other credible constellation sponsors are still appearing.

“We’re seeing multiple requests for communications satellite solutions and a growing number of constellation projects. Our opportunity pipeline remains strong,” Greenley said.

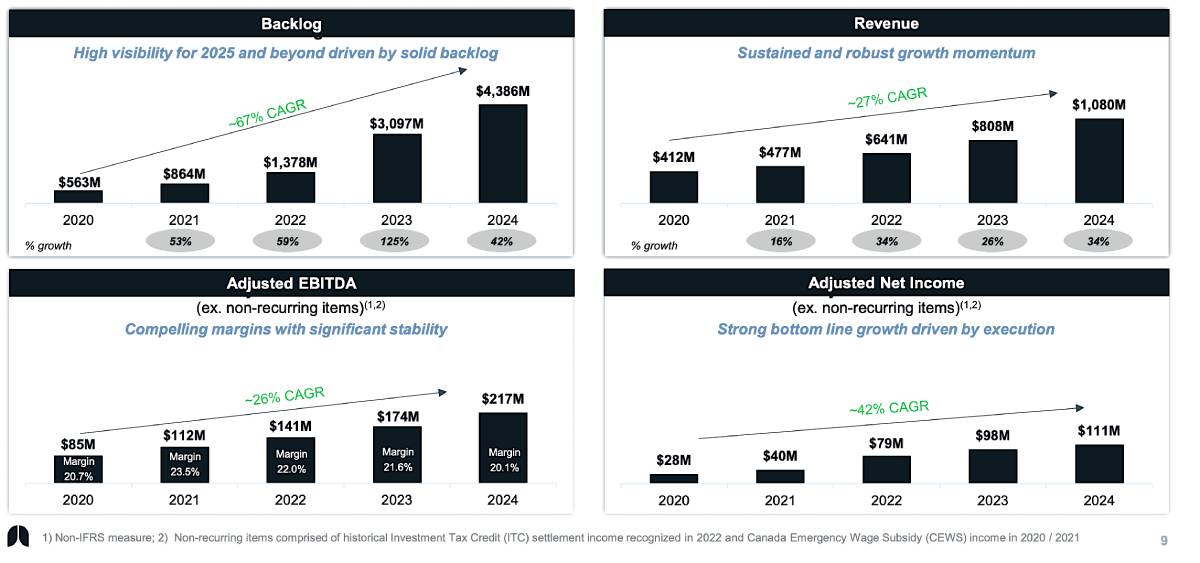

Figures are in Canadian dollars (CAD). With the latest EchoStar order, backlog surpasses CAD 6 billion Canadian. (Source: MDA Aug. 7, 2025, investor presentation)

Figures are in Canadian dollars (CAD). With the latest EchoStar order, backlog surpasses CAD 6 billion Canadian. (Source: MDA Aug. 7, 2025, investor presentation)

The EchoStar contract was signed after MDA’s Q2 financials were closed, but on a pro forma basis it brings the company’s backlog to 6 billion Canadian dollars, or 3.75 times MDA’s newly raised forecast for 2025 revenue.

Three of the four LEO constellations — Telesat’s 198-satellite Lightspeed broadband network, Globalstar’s 50-satellite Gen 3 D2D constellation, backed by Apple, and EchoStar’s 100-satellite D2D network — are all dependent on MDA’s new Aurora software-defined digital satellite product.

This is new hardware that these companies are now depending on to perform to spec right out of the box, starting late-2026 and early 2027 for Telesat and Globalstar, and 2028 for EchoStar. The Lightspeed and Globalstar satellites are due to complete critical design review this year.

A laboratory demonstration of a key satellite selling point

MDA only in July announced it had proven out a key selling point of its Aurora products, its direct radiating array antenna, using a prototype that will be connected to a prototype on-board processor to demonstrate communications from a satellite to a gateway Earth station and then to a user terminal.

“Customers can now observe the functioning MDA Aurora technology in a specially designed demonstration lab” in Montreal, MDA said.

The company has “digitally formed and steered multiple beams with its Ka-band direct radiating array using direct sampling, a first in the industry,” MDA said. “[D]irect sampling results in a more efficient and effective approach, allowing customers to save on satellite costs, mass and power consumption.”

Greenley said during the investor call: “Their successful validation marks a breakthrough for 5G networks and the digital payload tech for Aurora.”

(Source: MDA Aug. 7, 2025, investor presentation)

(Source: MDA Aug. 7, 2025, investor presentation)

Caution is nonetheless called for, and Greenley said the 185,000-square-foot expansion of the company’s Montreal satellite factory, which may be the largest of its kind, will start modestly.

Huge satellite factory opens by December, but production will start slowly

“Entering 2026, we’ll be capable of up to two satellites per day. That’s 400 satellites a year. In 2026 we don’t expect to get anywhere near that. We’ll have a much slower ramp of this new facility, and as we get into the year we’ll produce a few dozen satellites.

“In 2027, we’ll get to a couple of hundred satellites but still not use the full capacity of 400. Then more in 2028.”

Greenley acknowledged, as he has in the past, that each new customer wants reassurance that MDA is not filling its plate with more than it can digest.

“This is a key point of discussion that we always have,” he said. “We can do 2,000 satellites over the next five years. As these expansion orders come in there will be activity to use up the capacity. We will build up to solid production rates for sure in 2027 and 2028.”

MDA’s first Globalstar order, for 17 satellites and valued at $327 million, with Rocket Lab providing the satellite platforms and launch dispensers, is nearing completion. Half the satellites are on the factory floor, with the other half arriving soon after.

(Source: MDA Aug. 7, 2025, investor presentation)

(Source: MDA Aug. 7, 2025, investor presentation)

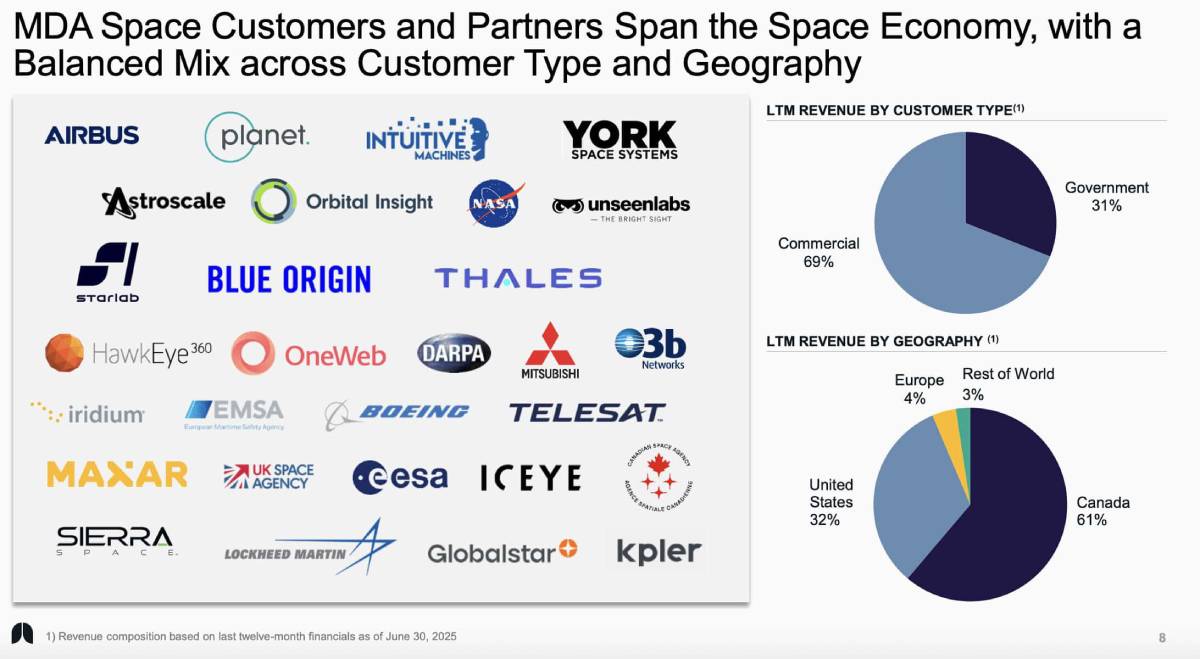

MDA is providing satellite components to US contractors build US Space Development Agency’s LEO missile-defense network, and through MDA UK is doing work for the 23-nation European Space Agency (ESA). Canada is not a full member but is an ESA Cooperating State, meaning it contributes to the agency’s budget.

Last year, ESA selected Toronto-based Kepler Communications to be prime contractor for demonstrations of 100-Gbps laser links on Kepler’s LEO network. it was the first time a Canadian company had won an ESA prime contract.

MDA in July said announced the selection of MDA UK as prime contractor for early work on an ESA/UK Space Agency-funded mission, called SkyPhi, with partners CGI and Open Cosmos to work on regenerative 5G D2D services.

Greenley said raising MDA’s profile in the United States and Europe with a possible acquisition remains a priority, even if, for now, the US tariff threat appears not to apply to MDA’s products. Greenley said have been cleared as acceptable under the U.S.-Mexico-Canada Agreement on trade.

“The US and Europe continue to be important areas for pipeline growth,” Greenley said. “M&A targets in Europe and the United States, to access those pipelines, continues to be an area of focus.”

Originally published by Space Intel Report on August 8, 2025. Read the original article here.