Pacôme Révillon, CEO of Novaspace, sets the tone for World Space Business Week 2025 with his market outlook keynote. (Source: Novaspace)

Pacôme Révillon, CEO of Novaspace, sets the tone for World Space Business Week 2025 with his market outlook keynote. (Source: Novaspace)

Key takeaways from Pacôme Révillon’s WSBW 2025 Opening Keynote

Each year, the World Satellite Business Week conference opens with a big-picture look at the forces reshaping the space sector. This year, Pacôme Révillon, CEO of Novaspace, delivered a powerful keynote that set the tone for the week ahead. His core message: The industry is once again entering a rollercoaster phase—dynamic and unpredictable, but brimming with opportunity.

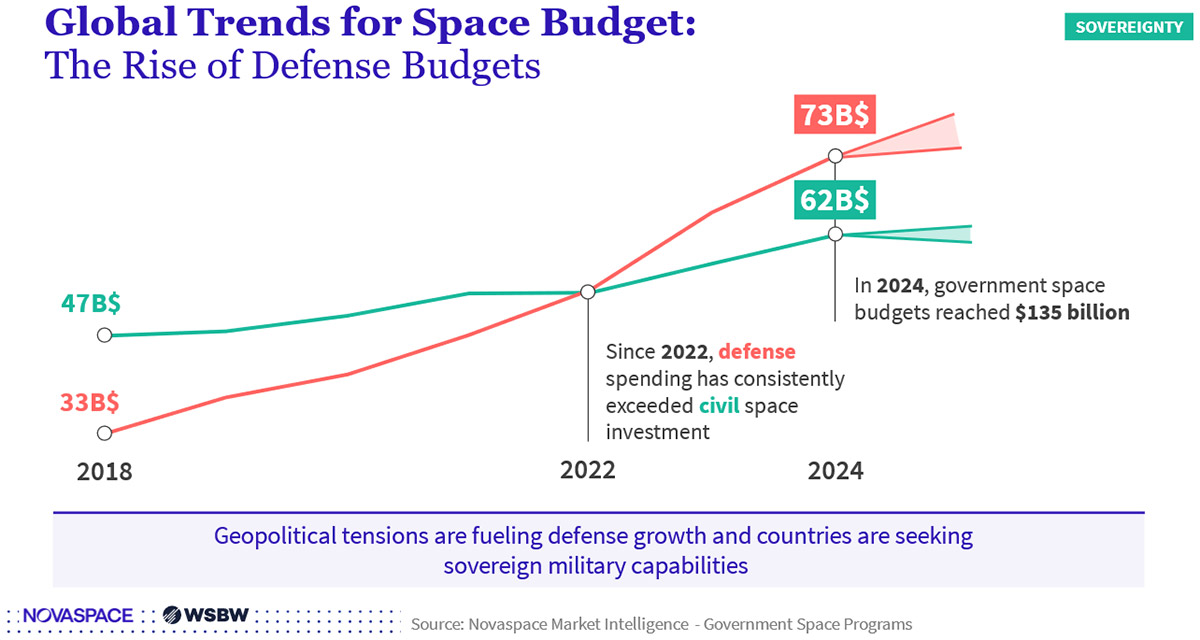

Lesson #1: Sovereignty Drives the Money

Government space spending reached an all-time high of $135 billion in 2024. For the first time, defense spending consistently outpaces civil investment. Nearly 100 countries and international organizations are now engaged in space programs—double the number from a decade ago.

This rapid expansion is not just about prestige; it reflects heightened geopolitical tensions and the race for sovereign capabilities. From satellite reconnaissance to secure communications, governments want to control their own assets—and they are willing to pay for it.

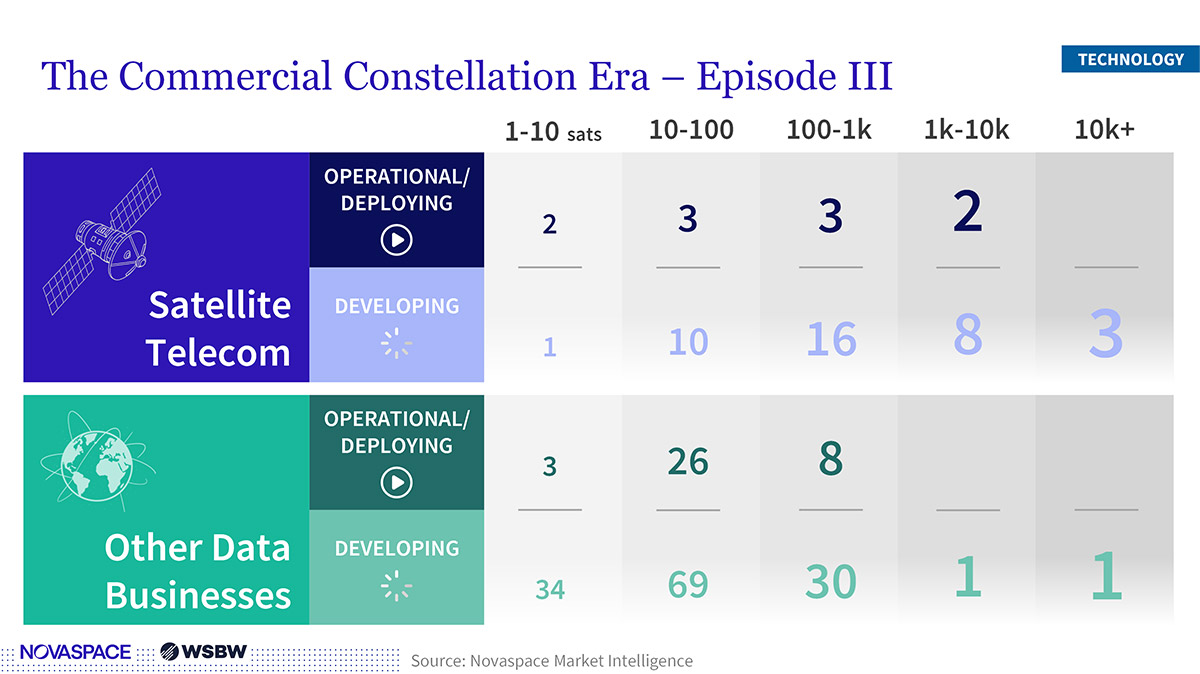

Lesson #2: Constellations and AI Reshape the Tech Frontier

The commercial constellation era is moving into its third phase, with hundreds of operators deploying satellites across telecom, Earth observation, and IoT. Scale is becoming the defining competitive factor.

On top of that, artificial intelligence is emerging as the next great disruptor. Beyond automating operations, AI is transforming mission planning, enabling predictive maintenance, and powering real-time analytics for new services. Révillon highlighted direct-to-device (D2D) as one of the most visible use cases: moving from basic SOS messaging toward mainstream voice and data services, with more than 300 million subscribers projected by 2030.

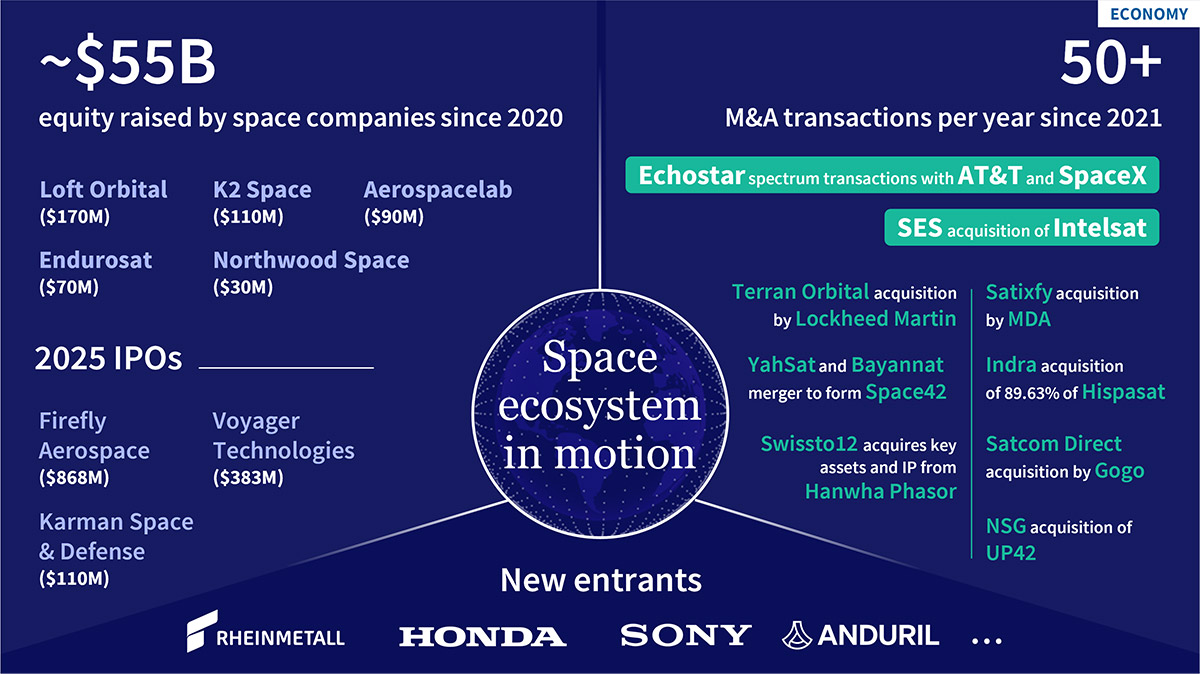

Lesson #3: The Space Economy is in Constant Motion

Investment momentum remains strong. Since 2020, space companies have raised over $55 billion in equity, while the sector has averaged more than 50 mergers and acquisitions annually.

This deal activity is reshaping the market at breakneck speed. Recent highlights include SES’s planned acquisition of Intelsat, YahSat’s merger with Bayanat to form Space42, and Lockheed Martin’s acquisition of Terran Orbital. The message is clear: Scale and integration are becoming prerequisites for survival, and the pace of consolidation is only accelerating.

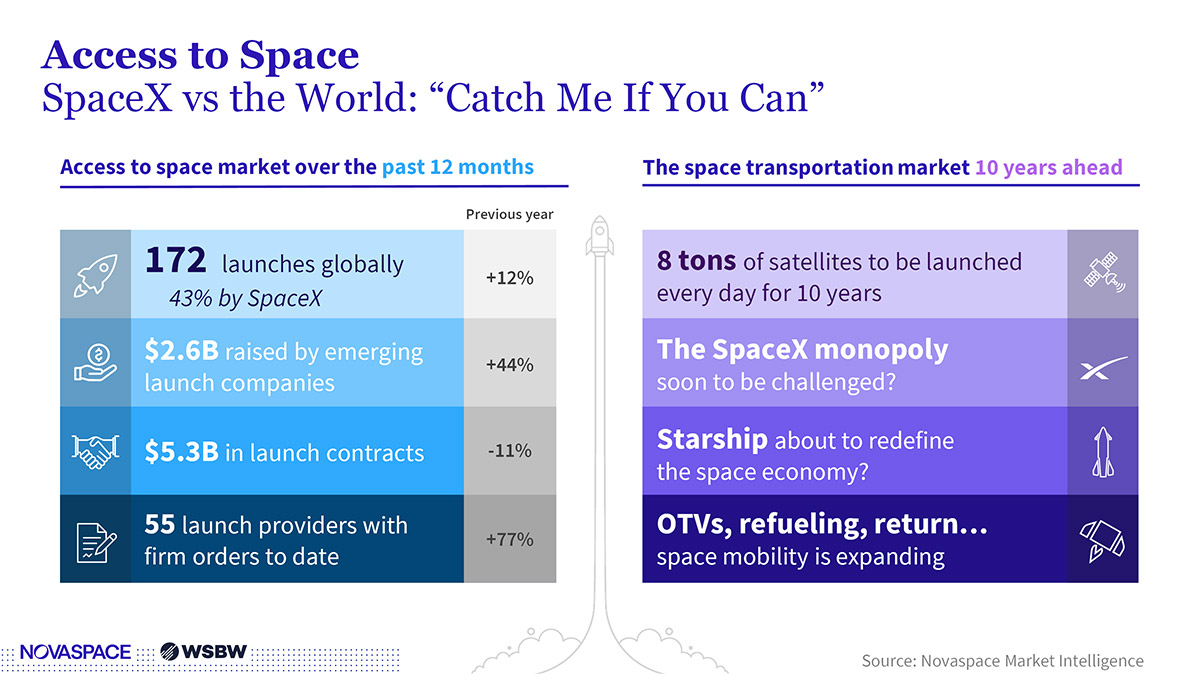

Lesson #4: SpaceX Sets the Pace—But Rivals are Lining Up

Access to space continues to be dominated by one player: SpaceX, with 43% of global launches in 2024. But rivals are not standing still. Emerging launch providers raised $2.6 billion over the past year, while the market for orbital transfer vehicles, refueling and in-orbit mobility is rapidly expanding.

And then there is Starship. If successful, it could redefine the entire economics of launch, manufacturing and satellite deployment. For competitors, the challenge is clear: carve out differentiated offerings in the shadow of SpaceX’s scale.

Lesson #5: New Horizons for Satcom and Data Markets

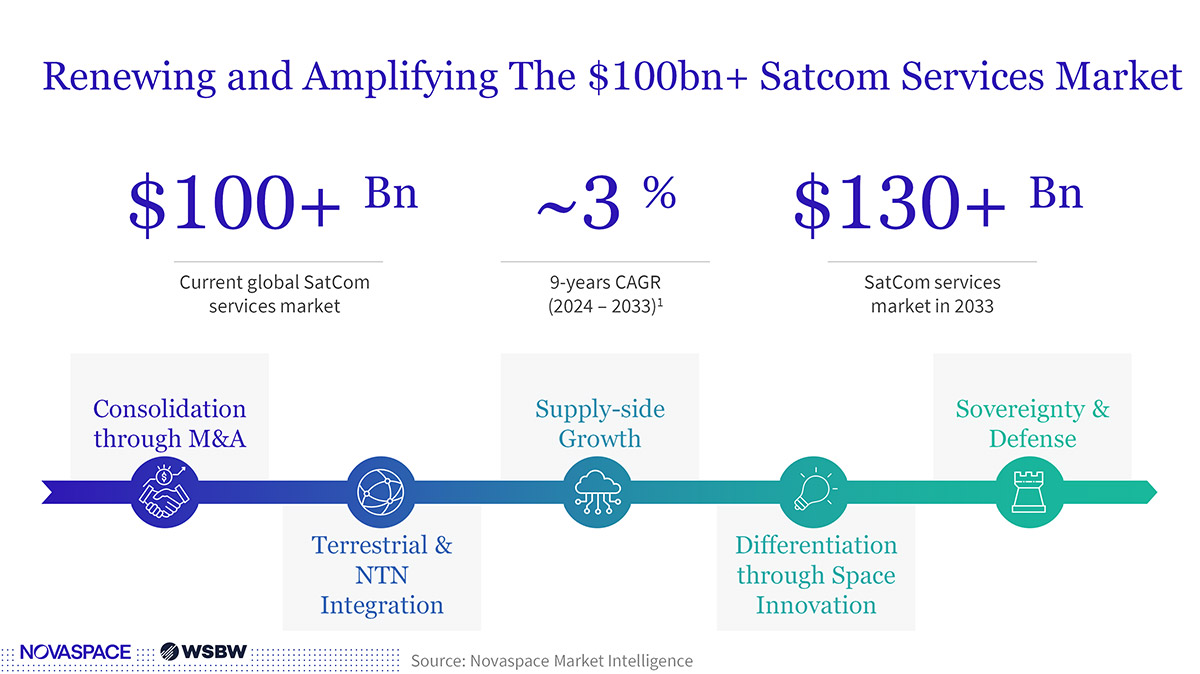

The global satcom services market, valued at $100 billion today, is projected to exceed $130 billion by 2033. Growth will be driven by the integration of terrestrial and non-terrestrial networks (NTN), spectrum innovation and above all the rapid rise of direct-to-device (D2D) connectivity.

D2D emerged as one of the defining themes of WSBW 2025, with a wave of announcements reshaping the competitive landscape. SpaceX and EchoStar unveiled a landmark $17 billion transaction, consolidating satellite capacity and distribution channels to accelerate global D2D deployment. Viasat announced a new strategic agreement with Space42, aimed at extending coverage to consumer handsets and IoT devices. AST SpaceMobile and Vodafone confirmed progress on their commercial service roadmap, while Lynk Global detailed new regulatory approvals enabling near-term service launches.

Taken together, these moves signal that D2D is transitioning from experimental pilots to a fully commercial business model, positioning it as a central growth driver for the satcom sector.

The bottom line

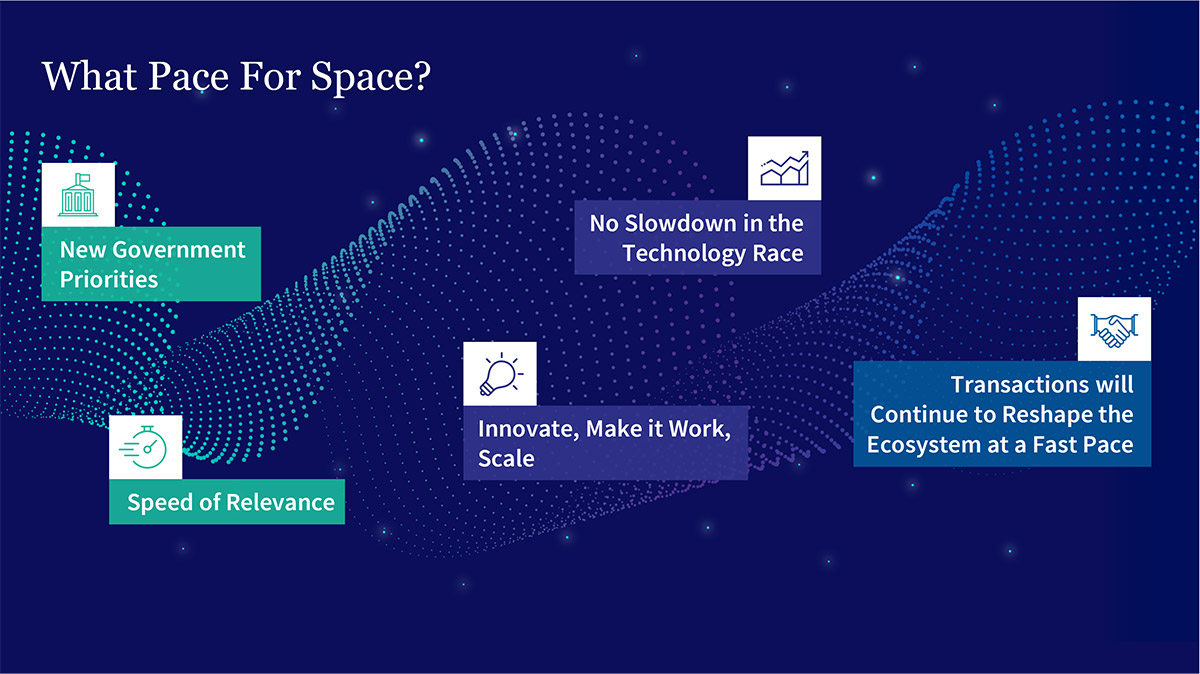

Révillon closed with a clear message: The space industry is defined by speed of relevance. Governments demand rapid delivery, technology cycles are accelerating, and consolidation is redrawing the competitive landscape. For businesses, success will come to those who can innovate quickly, adapt continuously and scale decisively.

The next phase of growth will not be a steady climb—it will be a rollercoaster ride. The question is: Who’s ready to buckle up?

About the author

Pacôme Révillon is the CEO of Novaspace, a global leader in space industry consulting and market intelligence. With more than 20 years of experience advising governments, space agencies, and commercial operators, he has been instrumental in shaping strategic initiatives across satellite broadcasting, communications, and finance. Under his leadership, Novaspace has become a trusted partner for decision-makers navigating the complexities of the space economy. Pacôme regularly speaks at international conferences, providing forward-looking insights into the trends reshaping space markets worldwide.